Business continuity and disaster recovery (BCDR) plans serve as an effective blueprint for keeping your clients’ operations afloat when disaster strikes and can help protect against potential threats. However, certain organizations are faced with unique compliance standards and industry-specific regulations that should be factored into any BCDR plan.

Keeping your clients safe, secure, and penalty-free is a must. Ensuring they meet today’s business continuity plan compliance requirements is a proactive step in preventing disruption and protecting their sensitive data and confidential information. We’re going to cover how the current threat landscape factors into compliance needs, some of the most common regulations you may have to meet, and how you can get your clients compliant from the start.

Business continuity planning is essential for compliance because it helps organizations meet regulatory requirements, ensure the continuity of critical operations, and protect sensitive information. A strong BCP can also solidify a business’s reputation and help avoid legal and financial penalties in the case of unexpected downtime. Additional benefits include:

Healthcare, finance, and government entities are required by law to have business continuity plans in place to keep their operations running and data safe despite disruptions (or face legal and financial consequences). Additionally, meeting business continuity and compliance regulations is a competitive advantage, as disaster recovery is a timely and costly process.

Part of what makes compliance such an intricate topic for BCDR is the variety of threats out there, all of which you need to account for in your plan.

First, there are the more obvious threats. Global cybersecurity attacks increased by a staggering 38% in 2022, many targeting critical business infrastructure. And with compliance standards higher than ever, MSPs must offer BCDR solutions that are flexible enough to adapt to specific industry standards.

Many cybercriminal organizations have focused on gaining access to digital collaboration tools used by remote or hybrid teams. Managing a host of client information and data can expose you as a major target for cyberattacks. Even with security measures in place, some phishing and ransomware attacks still occur.

Business compliance plans (BCPs) fit neatly to support this need from a recovery standpoint, but it also opens up your business to compliance concerns.

While cyberattacks may be one of the more glaring threats, they certainly aren’t the only ones that factor into compliance. Natural disasters and system failures can also impact downtime and data protection, but your clients are still responsible for keeping essential systems active in those scenarios. This especially applies in specific industries like healthcare or finance.

Failing to meet these requirements means incurring heavy legal, financial, and reputational penalties on the client side, and damaging credibility on the MSP. So, not only are the stakes high when it comes to compliance, but you have to be compliant in a variety of different situations.

For many organizations in the government, healthcare, and financial services sectors, having a business continuity and compliance plan is a legal requirement. Without one, an organization can face penalties for noncompliance.

Navigating the intricacies of business continuity and compliance regulations is challenging. Many professionals may not be deeply familiar with the specific laws and regulations required to establish an actionable business continuity plan for regulatory compliance.

Understanding business continuity for compliance as it relates to your client base is transformative. By fully integrating a company’s compliance with disaster planning, you empower them by safeguarding their sensitive data and meeting legal requirements.

Due to the Health Insurance Portability and Accountability Act (HIPAA), business continuity compliance is mandatory.

This requires health information systems to have advanced data management capabilities to protect critical and sensitive information—or risk a penalty ranging from $100 to $50,000.

In addition, organizations should comply with federal and any state-level regulations by having an actionable plan that establishes an emergency operational base during a crisis.

Financial organizations also must report to specific regulatory agencies and governmental policies. To ensure all financial data is secure and banking centers can remain operational in a crisis, the financial sector is bound by Financial Industry Regulatory Authority (FINRA) compliance mandates.

While specifics may vary from business to business, data retention is the overall goal of financial continuity compliance efforts. Data retention best practices include classification, compliance, and deletion.

Creating a business continuity compliance plan for your financial clients typically includes a strategy for each of the following elements:

You should also be aware of the following items for your financial sector clients:

In the event of a crisis or emergency, government centers must stay open and operational. According to the Federal Information Security Modernization Act (FISMA) and Executive Order 13636 on Improving Critical Infrastructure Cybersecurity, operations must resume in a crisis. However, the specifics are left up to local governments.

The National Institute of Standards and Technology (NIST) outlines a few key touchstones a business continuity and compliance plan should include:

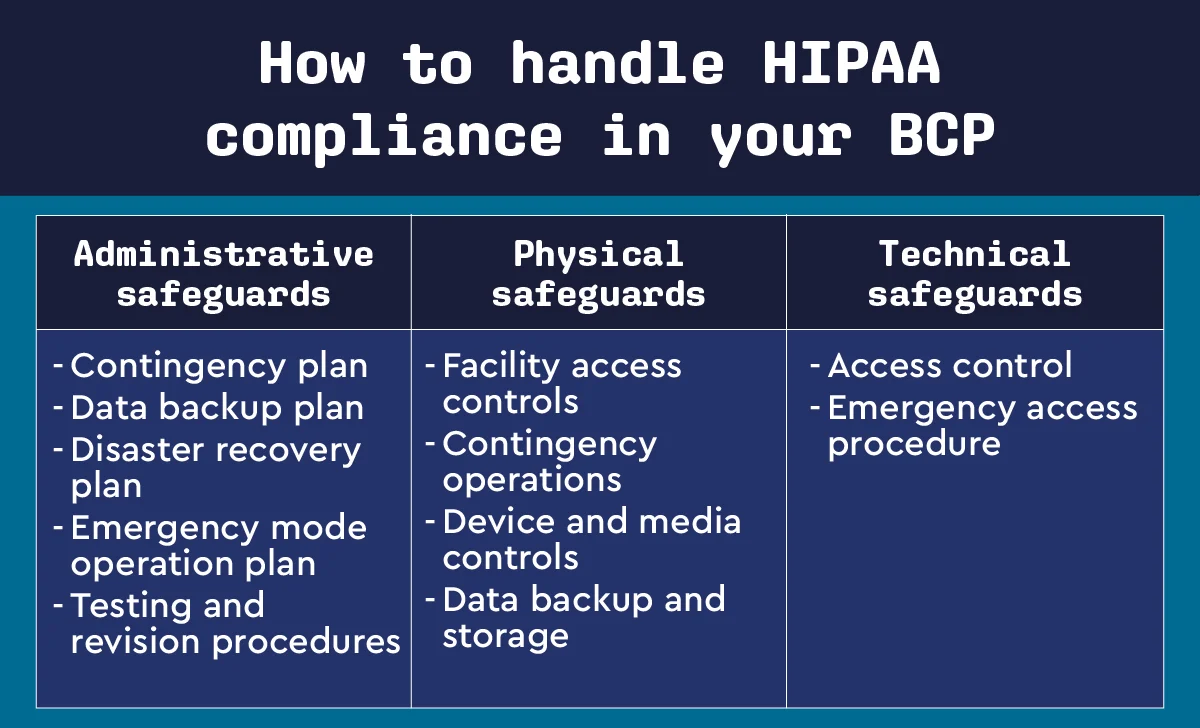

We mentioned HIPAA briefly earlier, but let’s dig deeper into healthcare-based compliance considerations. HIPAA regulations specify several criteria organized into three core categories:

Administrative safeguards

Physical safeguards

Technical safeguards

For your healthcare clients to remain HIPAA compliant, create a BCP that considers:

Payment Card Industry (PCI) compliance requirements ensure that all companies that process, store, or transmit credit card information maintain a secure environment. Payment brands and acquirers, the financial institutions that process debit and credit card transactions on behalf of the issuers, are responsible for enforcing compliance—rather than the PCI Security Standards Council (PCI SSC).

PCI DSS provides an extensive number of frameworks, blueprints, and resources to help organizations maintain optimal credit card security for cardholders. Determine what your clients use to store credit card information before developing an effective compliance program.

Nearly every industry—from restaurants to educational centers—has a specific set of industry-based rules, regulations, and compliance necessities. Understanding the standards and nuances of the key industries that comprise your clientele will ensure you have the right plans and software in place should disaster strike.

In addition to compliance with industry-based rules and regulations, make sure your clients’ BCDR plans comply with these well-known standards.

ISO 22301 is an international standard for business continuity and compliance requirements. It provides a clear and concise framework for organizations to effectively plan, establish, implement, operate, monitor, and improve their BCP systems.

Organizations leveraging ISO 22301 can enhance overall organizational resilience and reduce the impact of disruptive incidents or crises. With ISO 22301, businesses can better identify risks, develop response and recovery procedures, and ensure the right resources remain available.

NIST’s Cybersecurity Framework is a set of guidelines and best practices for managing and improving cybersecurity protocols.

Contingency plans are required to ensure operations during a crisis, particularly for government centers and operations. NIST’s framework helps organizations assess their cybersecurity posture, identify opportunities for improvement, and prioritize specific investments in cybersecurity.

In addition to ISO 22301 and the NIST Cybersecurity Framework, there are many other well-known standards you should remain aware of:

Depending on where your client is located, consider any relevant regional BCP compliance requirements. Although by no means a complete collection of all compliance regulations by region, this list provides a launching point to learn more.

Compliance requirements in the US

Compliance requirements in Canada

Directive on Security Management: The Directive on Security Management provides procedures and frameworks to navigate business continuity management practices, business impact analysis, business continuity plans, awareness and training, testing, and monitoring.

Compliance requirements in Australia

Compliance requirements in the UK

Compliance requirements in Ireland

Directive on Security of Network and Information Systems: The Directive on Security of Network and Information Systems concerns the security of network and information systems to protect critical infrastructure and economies.

Compliance requirements in New Zealand:

Compliance requirements in Benelux

Benelux Organization for Intellectual Property (BOIP): The BOIP implements regulations under the Benelux Convention on Intellectual Property regarding trademarks, industrial designs and property, intellectual property, and designs.

Your clients are counting on you to help minimize data loss and business downtime in the face of a natural disaster, cyberattack, or system failure. Business continuity planning is just one element of a successful BCDR strategy; MSPs need the technology and resources to deliver the protection clients demand.

With ConnectWise backup and data recovery solutions, you can provide peace of mind for your clients while protecting your reputation—and your revenue. Whether your data is hosted in the cloud, hybrid, or on-premises, you can rest assured knowing your critical assets are safeguarded by the best software in the industry. Watch a free demo of ConnectWise’s BCDR solutions to learn more.

For remote work environments, compliance with business continuity regulations remains critical. In addition to understanding the importance of a BCP, support your clients with a hybrid or remote workforce by:

Businesses operating in a remote work environment also greatly benefit from alternative forms of backup, such as direct-to-cloud backup. This allows laptops and systems to be adequately backed up regardless of location.

Leveraging a hybrid cloud infrastructure (a combination of on-site, private, and public cloud storage) is useful for ensuring business continuity compliance. Diversified backup options give businesses more control over where their data is stored, which helps to maintain BCDR regulations.

Maintain compliance with business continuity regulations while minimizing costs by adopting a risk-based approach. This involves conducting a thorough business impact analysis to identify potential losses and risks. Completing a BIA helps identify and prioritize which processes have the greatest impact on an organization’s financial operations.

Compliance requirements for business continuity in the event of a cyberattack typically involve a few key aspects. This includes:

Compliance requirements for business continuity can vary based on the type of data being protected. Highly sensitive data—most common with healthcare, financial, and government organizations—have stricter requirements, necessitating robust security measures.

Specific compliance requirements vary based on the type of data a company processes, where the country is located, and industry standards. However, an extensive business continuity and compliance plan will likely meet most disaster-related requirements of regulatory and government agencies.

Businesses can prepare for changes by staying updated on industry regulations and continuously maintaining a BCDR program. Develop contingency plans that review internal documentation and remove accounts of people no longer working with your client’s organization. This will aid in daily security efforts and mitigate future risks.