10/9/2025 | 21 Minute Read

Topics:

This is a newsletter courtesy of Service Leadership Inc.®, a ConnectWise company.

The impact of artificial intelligence (AI) and hyperautomation on the managed service provider (MSP) industry is rapidly evolving. This newsletter addresses the current state of hyperautomation while providing these key takeaways for readers:

AI as an academic discipline was founded in 1956, and 70-plus years later, due to considerable advancements in computing technology, AI and other hyperautomation technologies appear poised to unleash a wave of transformation and innovation for humankind. One does not have to look hard to find predictions for how hyperautomation will transform the way we live, work, and interact with the environment and one another. The 2024 edition of the Service Leadership Index® Annual IT Solution Provider Industry Profitability Report™ included a special section titled “Hyperautomation Impacts on TSP Profitability,” where we first explored the AI/hyperautomation landscape and the following critical success factors likely to play out over the coming years.

Fast forward to the second half of 2025, and while there has been progress in the adoption of hyperautomation solutions, the prevailing sentiment is that widespread adoption by IT solution providers is very much at the beginning of the adoption curve.

“I’ve said for 20 years that IT needs to be better at solving business problems with technology, not just technology problems. We have countless buzzwords like “digital transformation,” that get used because IT people aren’t great at truly delivering a high level of business value. If we look at what’s happening in services, the middle layer between commoditized and specialized IT services, is moving towards commoditization, and what’s opening up is this massive opportunity in the highly specialized area. That requires different skills, a different mindset, and different DNA than most MSPs have; it truly is consulting.”

Peter Melby, CEO, New Charter Technologies

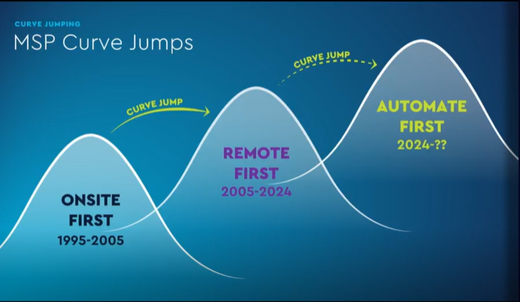

Figure 1: MSP industry curve jumps

For MSPs, the promise of adopting hyperautomation tools represents a significant shift—a “curve jump” to a new business model with automation at the core. As shown in Figure 1, 2024 marks the approximate timing of the MSP industry shifting to an “automate first” mindset, where automation is a core attribute of what it means to be an MSP. While the “remote first” period did see MSPs leverage remote monitoring and management (RMM) solutions and other tools to automate processes, they still required significant human interaction. As time passed, those efficiency gains tapered off mostly due to wage inflation. Shifting to an “automate first” focus is more than simply automating existing processes. Taking advantage of hyperautomation will require the redesign and reimplementation of new business processes with hyperautomation at the core and not simply as a bolt-on accessory. MSPs who embrace this mindset will be well-positioned to accelerate ahead of their peers in capturing the attention of customers and market share from the competition.

We will first look at the internal impact that hyperautomation represents for MSPs, along with the financial impact that is taking shape. We will touch on best practices for MSPs to achieve a successful outcome with hyperautomation and review a financial model illustrating how hyperautomation can drive stronger profitability for MSPs. Lastly, we will close by looking at some of the strategic considerations that MSPs are focusing on with hyperautomation.

First, let’s review some of the definitions and types of hyperautomation solutions that currently exist.

Agentic AI

So-called AI agents, assistants, or digital workers represent autonomous systems capable of setting goals, planning actions, making decisions, and executing tasks with minimal (if any) human intervention. Moreover, these systems are able to learn from feedback and improve over time, much like human beings.

Generative AI/large language model (LLM)

Generative AI/LLMs enable automatic generation of content and can provide answers to simple and complex questions via a conversational interface. These powerful systems require direct human input and function to enhance human productivity and efficiency.

Robotic process automation (RPA)

RPA workflows or “bots” automate the performance of specific, repetitive tasks that normally require human interaction. The primary goal of RPA solutions is to improve efficiency and reduce human error in repetitive tasks.

The MSP industry’s first taste of the impact of automation tools on service delivery and process automation coincided with the proliferation of RMM solutions, which powered the shift from an on-site-first service delivery model to a remote-first service delivery orientation.

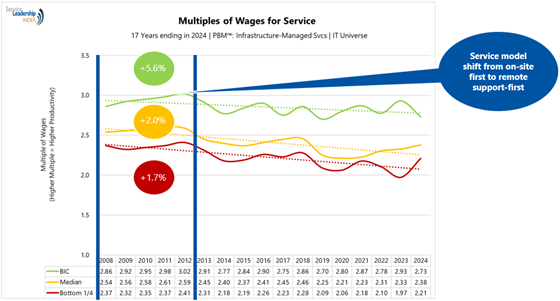

By 2012, the level of increased service efficiency that MSPs had achieved by adopting RMM solutions was able to be seen in the Service Leadership Index® data on the Multiple of Wages for Service, as shown in Figure 2.

Figure 2: Multiple of wages for service for infrastructure-managed services PBM 2008 -2024

As of 2024, the service multiple of wages for all three profit quartiles (BIC, median, and bottom ¼) had not rebounded to the levels seen in 2012. While RMM and professional service automation (PSA) solutions certainly enabled the automation of many operational functions of MSPs, those solutions fell short of generating sustained efficiency gains that one would expect from continued task and process automation.

The “automate first” curve jump shown in Figure 1 represents an opportunity for MSPs to achieve substantial operational and service efficiency improvements that result in increased productivity and ultimately greater profitability. For MSPs, the service multiple of wages metric is a key indicator that will very likely illustrate the impact of hyperautomation. What improvements in operational efficiency might MSPs see from hyperautomation? Just as was seen in the early 2000s, MSPs will almost certainly find varying levels of success in the results and outcomes they achieve.

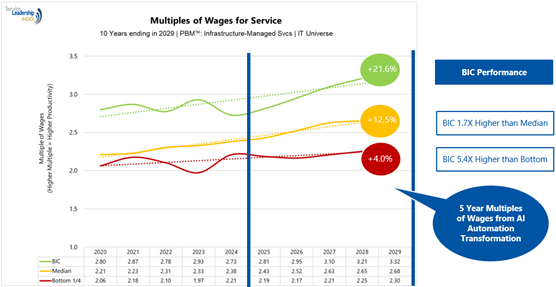

Figure 3: Projected multiple of wages for service for infrastructure-managed services PBM

Looking ahead to the future, what outcomes might MSPs see from successfully adopting hyperautomation solutions? It would be no surprise to see BIC MSPs recognize multiple wage improvements of 21.6% over the next five years (please see Figure 8 below for initial assumptions). As BIC MSPs incorporate hyperautomation further into their operations, labor cost savings by BIC MSPs will likely afford the BIC an opportunity to further differentiate themselves from the competition and capture additional revenue and profit.

The outlook for median MSPs, though not rosy, is still positive. Median MSPs are likely to see a slower realization of efficiency improvements in 2025, followed by somewhat stronger gains in subsequent years.

Bottom ¼ or low OML MSPs are unlikely to achieve significant efficiency improvements due to their poor strategic focus on hyperautomation, resulting in sub-optimal operational and financial outcomes compared to their peers in the BIC and median. Any gains that are realized will almost certainly face strong downward pricing pressure that will add to the difficulty of running an MSP.

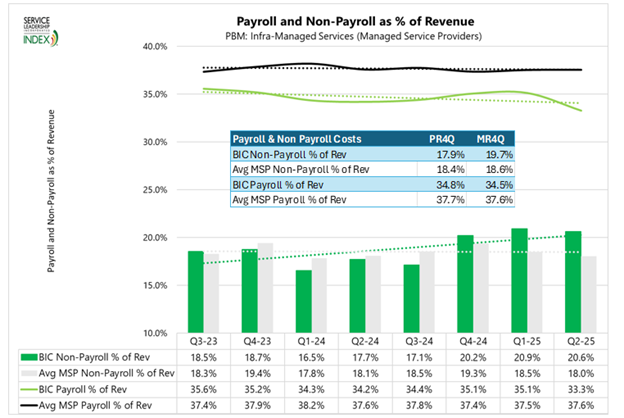

What impact are AI and hyperautomation solutions having on the financials of MSPs? The investments made by MSPs in adopting AI/hyperautomation solutions are starting to become visible in the percentage of non-payroll expenses as a percentage of revenue spent by BIC MSPs, as seen in Figure 4 below.

Figure 4: Payroll and non-payroll as a % of revenue for MSPs

In the most recent four quarters (MR4Q) compared to the prior recent four quarters (PR4Q), BIC MSPs increased non-payroll costs from 17.9% to 19.7% and saw a slight reduction of payroll costs from 34.8% to 34.5%. While initially that might not seem like a large reduction, any reduction in payroll costs as a % of revenue has a material impact, as payroll costs are the largest expenditure for service-based IT solution providers. The average MSP slightly increased non-payroll costs from 18.4% to 18.6% and saw a smaller reduction in payroll costs from 37.7% to 37.6% in that same period.

Given the anticipated impact of hyperautomation solutions on increasing service efficiency, it is very likely that this trend will continue as MSPs continue to invest in adopting hyperautomation solutions, shifting more of their expense burden from payroll to non-payroll.

So, what is the right approach for adopting hyperautomation solutions? The answer hinges on a company’s ability to cultivate an environment that embraces new thinking and reimagination of business processes, driven by critical investments in time, treasure, and talent. We will explore several factors that impact the degree of return on investment, including a company’s ability to cultivate an environment that embraces new thinking and hyperautomation tools.

The most obvious element that must be in place is the hyperautomation tools themselves. The depth and breadth of tools vary, and so does the direct license cost. The choice of solutions ranges from pre-built low-code/no-code solutions that don’t require extensive customization by highly skilled technical talent to hyperautomation solutions that are fully customizable and extensible in the hands of highly skilled, i.e., expensive, technical talent. The optimal choice is one that extends beyond the actual direct monetary expense and is one of several factors that should be carefully considered, just the same as any investment. The appropriate level of cost is the one that ensures the desired level of profit (or greater) can be obtained for the services being provided by the organization.

We define success in hyperautomation as generating three outcomes:

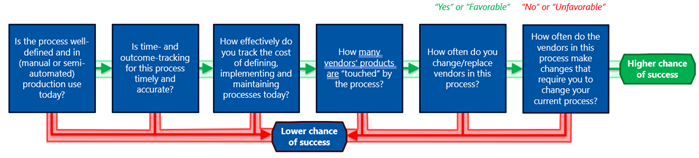

The chance of success for achieving the above outcomes is predicated on the extent to which processes are automated. The extent to which processes are automated is a function of:

Successfully navigating the “automate first” curve jump (see Figure 1), by all appearances, looks to be quite different than the shift from “on-site first” to “remote-first.” The remote-first curve jump resulted in a reduction in the lag time for resolving reactive issues through a combination of proactive problem resolution and the ability to remotely remediate. The “automate first” model puts autonomous agents and systems front and center with minimal human oversight. The critical starting point for that shift is that processes must be thoroughly and accurately defined, re-imagined, and ultimately re-invented to enable hyperautomation tools to operate with little to no human intervention.

Figure 5: Process automation success factors

The initial implementation and process definition is the critical first step, which will factor heavily in the level of success an MSP is able to achieve with adopting hyperautomation solutions. If done well, that will have a positive influence on the degree to which an MSP is able to monitor, maintain, and continuously improve the effectiveness and efficiency of processes driven by hyperautomation. The continued allocation of time, treasure, and talent will likely be a critical factor behind why some MSPs fall short of their desired level of success, while others accelerate their growth and profitability. As service-oriented businesses, human capital will continue to be the most important resource that drives MSP success. As service efficiencies are realized through continued process automation, staffing requirements will shift, allowing MSPs to reorient the composition of their staff.

BIC MSPs, those generating top quartile levels of profitability and growth, have developed a strong understanding and ability for operating a well-run “service factory.” In other words, their service delivery processes require a minimum level of investment that allows for the delivery of managed services at a repeatable and scalable level of quality and profit. Two key determinants that influence the degree of efficiency gains an MSP may achieve with an investment are:

Having a standard tech stack deployed across a larger proportion of the customer base greatly improves the potential gains earned from applying efficiencies against that customer base. When combined with a high proportion of customers on the most fully managed contract offering, the ideal scenario for an MSP is created that spreads investment costs across their customer base, greatly improving the likelihood of success and return on said investment.

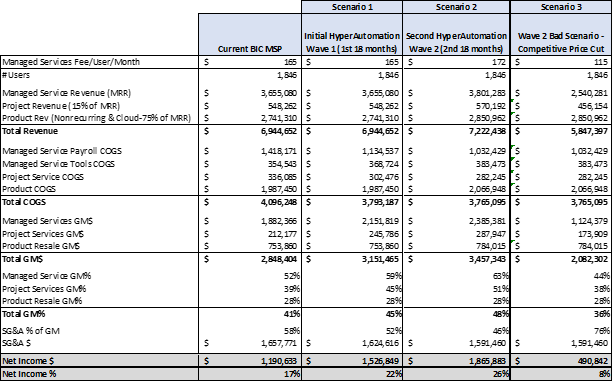

It is well understood that hyperautomation represents a compelling opportunity for MSPs to potentially drive significant gains in service efficiency (W2 multiple), which in turn can drive GM$ and GM% growth, and stronger EBITDA profitability. Let’s take a look at several scenarios modeling out the impact of retaining labor cost savings from hyperautomation adoption versus sharing cost savings with customers:

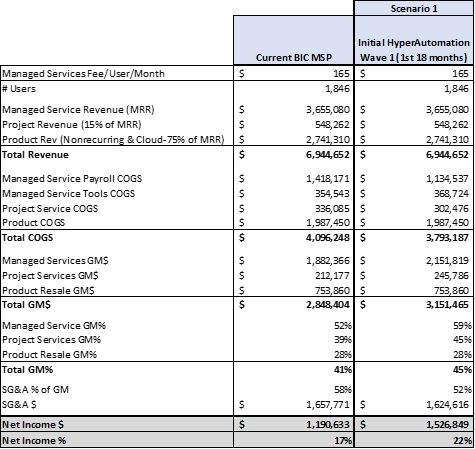

Scenario 1: Initial hyperautomation wave #1 (first 18 months) assumptions:

Figure 7: BIC MSP hyperautomation scenario—first wave

In the first column of Figure 7, for Scenario 1, we start with some figures representing a BIC MSP, with an average service and product revenue mix. In the second column, we model out the potential impact of service efficiencies powered by hyperautomation. With no changes in revenue, and reductions in managed services and project services labor COGS, the following potential outcomes are:

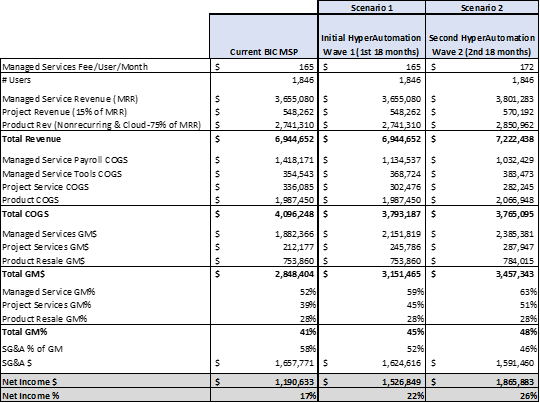

Let’s model out what further improvements might be realized from continued efficiency gains that, in turn, enable the delivery of greater value coupled with (slightly) increased managed service pricing.

Scenario 2: Hyperautomation wave #2 (second 18 months) assumptions

Figure 8: BIC MSP hyperautomation scenario—second wave

Regular (typically annual) price increases are a key behavior of BIC MSPs that sets them apart from the competition. In Figure 8 with Scenario 2, the $172 per-user-per-month price represents a 4.2% increase. In the face of declining service COGS along with increased competition, the temptation to reduce prices is very real. Resisting the pressure to reduce prices is a key factor that we anticipate will correlate highly with the short and long-term financial outcomes MSPs experience. In a potential second wave of further improvements that drive additional reductions in labor COGS and SG&A, the model shows an additional 4% increase in total GM% and a 4% increase in net income %.

A key attribute of BIC MSPs is the usage of value-based pricing that factors in a target GM % as well as cost improvements in risk reduction and business productivity. For some MSPs, the prospect of COGS reductions from hyperautomation will be (incorrectly) treated as an opportunity to use price cuts as a strategy to outcompete the competition. Let’s evaluate a scenario where a price cut is used as a competitive tactic.

Scenario 3: Hyperautomation wave #2 with price cuts assumptions

Figure 9: BIC MSP hyperautomation scenario—second wave with price cuts

In Scenario 3 shown in Figure 9, although the price decrease is matched with a corresponding decrease in payroll COGS, the 15% decrease in managed service GM % and 9% decrease in total GM % would have to be matched with a 50% decrease in SG&A to maintain a 22% net income. Additionally, there is only a certain point that can be cut in SG&A, as some expenses are core functions for running a business. The takeaway of this scenario is that without drastic cuts in COGS and SG&A, pricing cuts will erode gross margins and thus are an ineffective strategy for business growth.

These three scenarios were purposely modeled with no organic growth in new or existing customer accounts to allow for a clearer illustration of the potential impact hyperautomation may have on driving efficiencies through reduced payroll COGS and SG&A. A common mistake of lower maturity MSPs is overemphasis on growth at the expense of profitability. The reality that we have observed is that the most profitable MSPs are those who are also growing the fastest. Let’s look at a final scenario further illustrating how price cuts can place an MSP in a hole that even with very strong growth is difficult to emerge from.

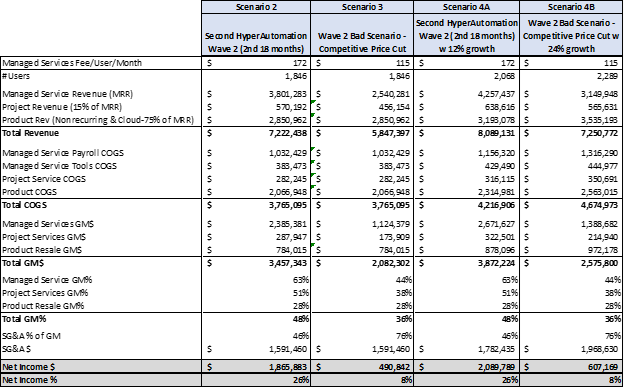

Scenario 4: Hyperautomation wave #2 with price cuts and growth assumptions

Figure 10: BIC MSP hyperautomation scenario—second wave (average growth) vs. bad scenario (above average growth)

The MSP industry has historically averaged approximately a 12% annual growth. In Figure 10, for scenario 4A, we use a 12% historical growth figure for the second hyperautomation wave, contrasted against the wave #2 bad scenario, 4B, with a 24% growth projection. Even with the growth rate of double the industry average, the outcome is still a low profit MSP at 8% net income. We show these scenarios to illustrate that even with above-average growth, hefty, indiscriminate price cuts that move a managed service provider closer to commodity pricing can easily leave a company in a worse state than where it previously was. Achieving BIC profitability does not need to come at the expense of growth.

At first glance, it is tempting to frame hyperautomation as another tool that will help MSPs and their clients become more efficient; however, there is a deeper impact that is only beginning to be understood and requires a clear and intentional communication plan. The focus that many MSPs have is on how hyperautomation will improve customer experience and drive stronger alignment to business outcomes that matter for both MSPs and their clients. BIC MSPs own the conversation with their clients. They face the same rapid AI changes and uncertainty as MSPs, and need guidance to help them navigate what they should be doing.

Some key elements of a client communication strategy include:

The prospect of having one’s job eliminated due to hyperautomation is arguably the most common sentiment heard that incites fear and negativity amongst staff. It is imperative that MSPs are deliberate in their approach so that employees have clarity on how hyperautomation will impact them, and furthermore, the benefits they can expect that will improve their quality of life. Some critical elements to communicate with employees include:

Beyond the impact on staffing levels, hyperautomation is also reshaping the types of job roles sought by MSPs as a result of the different skills and abilities required by MSPs to successfully transition to a new hyperautomation-driven world. New roles, such as chief innovation officers, data scientists, RPA leads, and development teams, are emerging to drive innovation and adoption of AI technologies. Roles within the organizations are evolving, with an emphasis on building a workforce skilled in high-value consulting focused on business process reinvention and workflow optimization. This, in turn, helps to bridge the gap between technology and business.

Focus on making the overall customer experience more effortless and improving margins. You can measure operational impact through metrics such as efficiency (time per ticket) and customer effort scoring. You can also track AI productivity through “AI FTEs,” quantifying the amount of work automation performs compared to human effort.

One of the primary concerns with hyperautomation solutions is ensuring the inherent set of risks that exist and ensuring they are known, understood, and mitigated as much as possible. Information security of data is one of the most well-known risks with hyperautomation solutions. Data input, storage, mapping, and maintenance must be carefully managed and controlled, as improper input of data may potentially result in the dissemination of sensitive data to unauthorized internal or external parties. Some key considerations for a strong hyperautomation governance strategy include:

Hyperautomation represents a transformative opportunity for MSPs to evolve beyond traditional service delivery models. By integrating advanced technologies such as Agentic AI, machine learning, and RPA, MSPs can streamline operations, reduce costs, and deliver more proactive, value-driven services to their clients. However, realizing these benefits requires a strategic approach—one that balances innovation with operational readiness and client-centricity. As the pace of digital transformation accelerates, MSPs that embrace hyperautomation will be better positioned to lead in a competitive landscape, driving both growth and resilience in the years ahead.